Don't Tax the Robots!

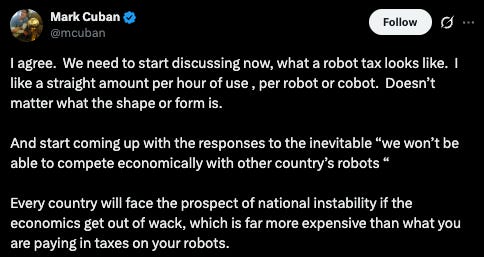

"Tax the Robots" is the dumbest idea I've heard Mark Cuban utter.

I spent the first part of my career on Wall Street, obsessed with a single variable: Alpha.

At the hedge fund I co-founded, we chased it by automating grunt work: building systems to read financial statements faster than any army of junior analysts could.

We didn't call it "AI" back then. …